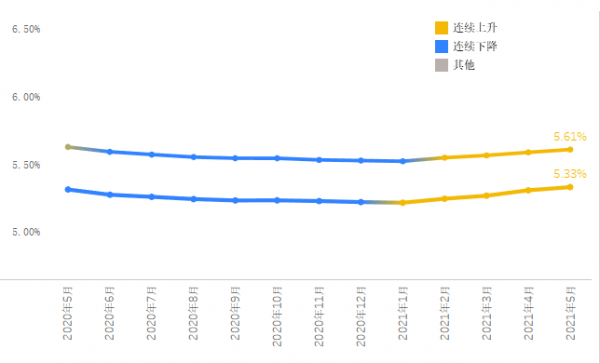

1. Mortgage Rate: National Average Second-home Mortgage Rate Increased by 2 BPs MoM

According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute (Rong360 Big Data Institute) across 42 cities for May 2021 (with data in statistics collected from April 20, 2021, to May 18, 2021), the national average mortgage rate for first-time homebuyers reached 5.33%, increasing 2 basis points (BP) month on month (MoM); The national average mortgage rate for the second-time homebuyers was 5.61%, up 2 BPs MoM.

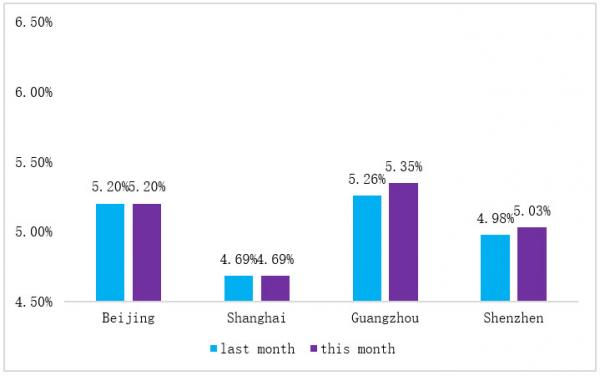

2. City: Two of the Tier-1 Cities Recorded Increases in Mortgage Rates

According to surveillance data from Rong360 Big Data Institute across 42 cities for May 2021 (with data in statistics collected from April 20, 2021, to May 18, 2021), twenty-one cities recorded an increase in average mortgage rates compared with the prior month. Three cities’ mortgage rates increased by over 10 BPs.

Among tier-1 cities, Beijing and Shanghai’s mortgage rates remained steady, while Guangzhou and Shenzhen recorded increases in mortgage rates. Since June 2020 in Shenzhen, the mainstream level of the first-home mortgage rate was around 4.95%, and the average level was steady at 4.98%. In May 2021, most banks in Shenzhen adjusted the first-home mortgage rate to a higher level, driving the mainstream level and average level of rates higher to 5.10% and 5.03%, respectively.

In Guangzhou, the mortgage rate has risen for four consecutive months, with the first-home mortgage rate increasing to 5.35% from 5.26% in the prior month. From late April to early May, many banks in Guangzhou, including some state-owned banks, increased mortgage rates. Bottom lines for first- and second-home mortgage rates were at 5.40% (LPR+75BP) and 5.60% (LPR+95BP), respectively, both up by 10BPs from the prior levels.

3. More than Ten Regions First Announced Centralized Land Bidding Rules; Regulations on Property Market are Multi-pronged

This year, 22 cities launched a trial implementation of the “two-centralized” land supply policy, which refers to the centralized release of land transfer announcements and centralized organization of transfer activities, conducting the centralized supply of land simultaneously. As of May 17, twelve of the twenty-two cities, including Beijing, Hangzhou, Guangzhou, Xiamen etc., have launched the first batch of centralized land auctions, with deal volume of RMB522.1 billion. In late May, Nanjing, Jinan, Ningbo, Suzhou and some other cities will also launch the first batch of centralized land auctions.

In 2021, the property market set a new round of tightening regulations with multi-pronged policies. Corresponding measures aimed at real estate enterprises, financial institutions, agencies and real estate speculators have also been introduced.

First, capital flows of personal consumption loans and business loans into the property market are strictly investigated. In addition, the Ministry of Housing and Urban-Rural Development has repeatedly interviewed leaders of popular cities. All regions have gradually increased restrictions on house purchases and sales, and further tightened property market regulations. There has been a serious crackdown on real estate speculation. Private real estate speculators such as the "Shen Fang Li" have been jointly investigated. Many places have launched special rectifications against real estate agencies. The Hangzhou Property Market Management Service Center and the Hangzhou Real Estate Agency Industry Association conducted successive inspections on real estate agencies. On May 11, the Housing and Construction Bureau of Xi’an Municipality notified three typical cases violating housing sales laws and regulations. The relevant departments of Nanjing investigated and punished the “fake talents and real housing speculation” incidents of real estate agencies’ violations. On May 14, the Housing and Construction Bureau of Guangzhou Municipality cooperated with the Guangzhou’s Education Bureau, the Guangzhou Municipal Administration for Market Regulation, the Local Financial Regulatory Bureau of Guangzhou, the Guangzhou Housing Provident Fund Management Center and other departments, carrying out a three-month special joint rectification action on property market orders across the city. In addition, Qingdao, Dongguan and other cities are carrying out inspections of real estate agencies.