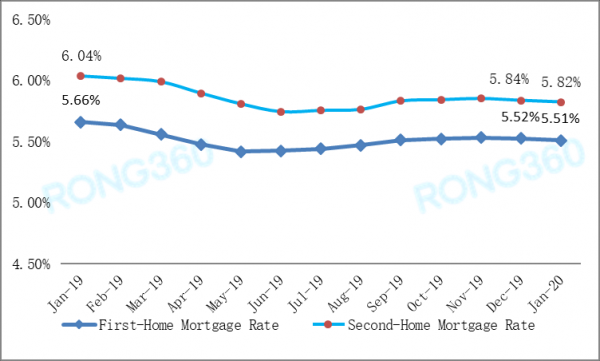

Mortgage rates: 2020 mortgage rates have declined at the beginning of the new year; mortgage rates for first-time homebuyers declined to 5.51% nationwide

The monitoring data based on 35 key cities released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute shows the average mortgage rate was 5.51% nationwide for first-time homebuyers in January 2020. As demonstrated by data collected from December 20, 2019 to January 19, 2020; posting a decrease of 1 basis points (BP) on a month-on-month (MoM) basis. And 71 BP have been added over the five-year loan prime rate (LPR). Additionally, the average mortgage rate for second-time homebuyers was 5.82%, posting a decrease of 2BP on a MoM basis. Specifically, 102 BP have been added over the five-year LPR for second-time home buyers.

Starting in January 2020, Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute has expanded research capacity by broadening our tracking samples to 41 cities and 673 bank branches (and sub-branches). According to our bank loan rate monitoring, the average mortgage rate was 5.53% nationwide for first-time homebuyers in January 2020, and 5.84% for second-time homebuyers.

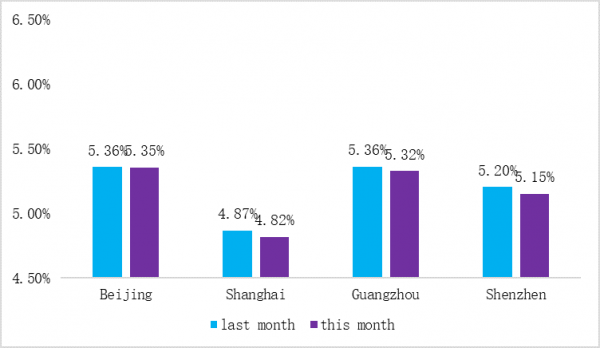

- Cities: 20 cities have lowered mortgage rates for first-time homebuyers; Shanghai mortgage rate has hit a new 30-month record low

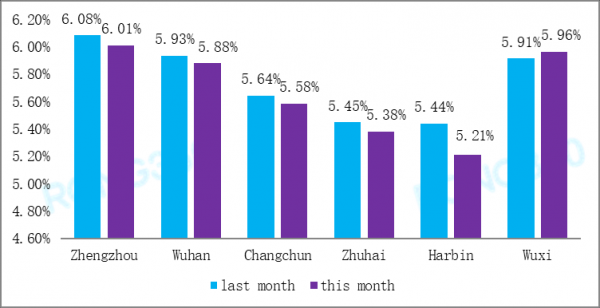

The monitoring data released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute shows that mortgage rates for first-time homebuyers among 20 cities were lowered in January 2020. Among these cities, 7 of them posted a decrease of more than 5BP, and Harbin posted a decrease of 23 BP MoM. First-time homebuyer mortgage rates in 11 cities increased, and Wuxi showed the highest increase of 5 BP.

Among Tier 1 cities, Beijing, Shanghai, Guangzhou and Shenzhen all saw mortgage rates for first-time homebuyers drop in January 2020. Month-over-month rates for Beijing decreased 1BP again this month and 4BP in Guangzhou. The average mortgage rate decreased 5BP in both Shanghai and Shenzhen. After the decrease, the mortgage rate for first-time homebuyers was 4.82%, a new record low for the last two-and-a-half years in Shanghai.

Among Tier 2 cities, mortgage rates for first-time homebuyers decreased more than 5BP in 5 cities. The mortgage rate decreased 23BP MoM to 5.21% in Harbin. Among the cities whose mortgage rates increased, Wuxi showed the most prominent rate rise of 5 BP, while other cities were not as prominent.

- Banks: 453 banks maintained mortgage rate levels as the prior month; Bank credit lines begin to ease

Among the 673 banks branches (and sub-branches) across 41 cities monitored by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute, 106 banks lowered mortgage rates for first-time homebuyers in January (excluding newly added banks and banks that suspended debt), in contrast to 175 banks t in the prior month. 453 banks kept the similar level as the prior month, versus 278 banks in the prior month. 46 banks increased the mortgage rate MoM, versus 68 banks in the prior month.

Among the 673 banks’ branches (and sub-branches) monitored by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute, bank credit lines have begun to ease while only 18 banks loan servicers have been suspended temporarily.

- Rankings: Harbin decreased a mortgage rates for first-time homebuyers by 23 BP MoM; Huizhou was newly added to the top ten cities with highest first -home mortgage rate.

Graph 1 Ten Cities with the Lowest Average First-Home Mortgage Rate in January 2020

|

城市/City |

2020年1月平均利率/ Average rate in Jan.2020 |

环比(BP)/ MoM (BP) |

LPR加点数/ LPR Increse |

|

上海/Shanghai |

4.82% |

-5 |

-3 |

|

厦门/Xiamen |

5.10% |

-1 |

25 |

|

天津/ Tientsin |

5.14% |

-1 |

29 |

|

深圳/Shenzhen |

5.15% |

-5 |

30 |

|

乌鲁木齐/ Urumqi |

5.19% |

1 |

34 |

|

哈尔滨/ Harbin |

5.21% |

-23 |

36 |

|

广州/Guangzhou |

5.32% |

-3 |

47 |

|

北京/Beijing |

5.35% |

-1 |

50 |

|

杭州/Hangzhou |

5.36% |

-3 |

51 |

|

海口/Haikou |

5.37% |

3 |

52 |

Source: Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute

Graph 2 Ten Cities with the Highest Average First-Home Mortgage Rate in January 2020

|

城市/City |

2020年1月/ Jan.2020 |

增长BP/ Increase BP |

LPR加点数/ LPR Increase |

|

南宁/Nanning |

6.27% |

4 |

142 |

|

苏州/Suzhou |

6.08% |

-4 |

123 |

|

郑州/Zhengzhou |

6.01% |

-7 |

116 |

|

惠州/Huizhou |

5.99% |

- |

- |

|

无锡/Wuxi |

5.96% |

5 |

111 |

|

合肥/Hefei |

5.88% |

0 |

103 |

|

武汉/Wuhan |

5.88% |

-6 |

103 |

|

南昌/Nanchang |

5.85% |

-1 |

100 |

|

中山/Zhongshan |

5.77% |

4 |

92 |

|

成都/Chengtu |

5.77% |

0 |

92 |

Source: Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute

In January 2020, among the ten cities with the lowest first-home mortgage rates, eight cities lowered their mortgage rates, while Haikou and Urumqi increased. Haikou is the only region in the ten cities that increased its mortgage rate for two consecutive months. Huizhou was newly added to these ten cities’ list with the average mortgage rate of 5.99% in January 2020 for first-time homebuyer. It’s ranked right after the Nanning, Suzhou and Zhengzhou, which has the rate higher than 6%. Accordingly, Xi'an was ranked out of top ten cities.

- Trends: Existing mortgage loan conversion work is about to start; LPR downward trend expectation enhanced

At the end of 2019, the “Pricing Existing Floating-rate Loans Conversion Plan” was officially launched, providing two types of conversion plans for mortgage borrowers: either changing to the LPR pricing benchmark floating rate loan contract or switching to fixed rate loan contract. In the long run, since there is a large space for LPR to go downward, so most users may prefer the LPR pricing benchmark floating rate contract, which means the bank's income from existing loans will also shrink in the future.

However, the conversion of existing mortgage contracts will not further affect the trend of mortgage rate for new contracts. The macro control of mortgage loan regulation policy is still the decisive factor in determining the trend of the mortgage rate. In 2020, the real estate regulation will insist on the principle of “no speculation on housing”. “Real estate policy in line with local circumstances” will be gradually implemented in various regions of the country.

On February 3, considering the epidemic prevention and concentrated expiration of market funds, the central bank carried out a 7-day reverse repurchase operation of RMB900 billion and a 14-day reverse repurchase operation of RMB300 billion. The open market operation rate (OMO) was lowered by 10BP comparing with the last time. The liquidity released by the central bank exceeded expectations. Subsequently, there is a high probability MLF interest rate level will be lowered in the later stage, which will lead to the decline of LPR.

Therefore, the mortgage rate may still maintain a steady and slow decline in the short term due to various factors such as the cities’ locally real estate policy, LPR ’s downward expectations, and the bank ’s sufficient credit line at the beginning of the year.