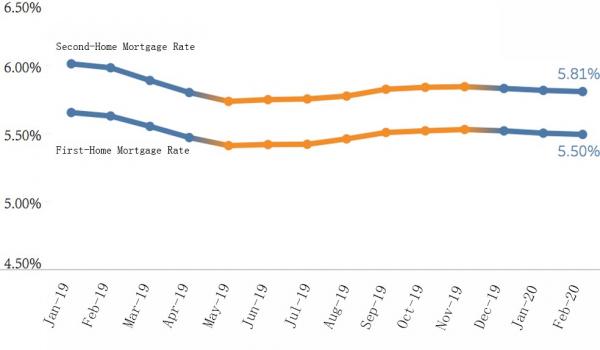

- Mortgage Rates: Mortgage Rates tend to be stable Nationwide With a 1 BP Decrease on a Month-On-Month Basis in First-Home and Second-Home Mortgage Rates

According to the monitoring data released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute about 533 bank branches in 35 key cities, the average mortgage rate for first-time homebuyers was 5.50% in February 2020(Data collected from January 20 to February 19, 2020), posting a decrease of 1 basis point (BP) on a month-on-month (MoM) basis and corresponding to a five-year LPR adding 70 BPs, while the average mortgage rate for second-time homebuyers was 5.81%, posting a decrease of 1 BP on a MoM basis and corresponding to a five-year LPR adding 101 BPs.

Since 2020, Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute has extended its envelope of sample data monitoring to cover 673 bank branches in 41 cities. The average mortgage rate for first-time homebuyers under monitoring was 5.52% in February 2020. Additionally, the average mortgage rate for second-time homebuyers was 5.83%, posting a 1 BP decrease on a MoM basis for both.

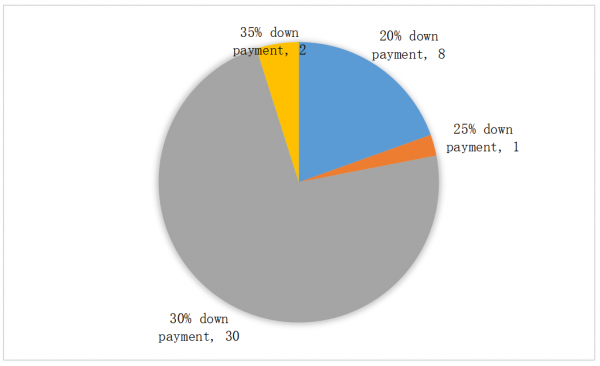

- Down Payment: 30% Down Payment in 70% of The Cities and 20% in Most Non-Buying-Restricted Cities

Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute showed that in February 2020, 30 cities, accounting for 73% of 41 cites under monitoring, had a mainstream 30% down payment for the first-time homebuyers, including two Tier 1 cities Guangzhou and Shenzhen, and 28 Tier 2 cities such as Nanjing and Hangzhou. Eight cities requested a mainstream 20% down payment for the first-time homebuyers, including Nanning, Harbin and Changchun, among other cities. Two Tier 1 cities, Beijing and Shanghai, requested a 35% down payment for the first-home mortgage. In Huizhou, a 25% down payment was mainstream for the first-home mortgage.

It is apparent that the majority of the cities currently request a 30% down payment for the first-time homebuyers. Nevertheless, the 41 cities monitored by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute have a rather prosperous market relative to the national market. A few of these cities that do not implement a buying-restricted policy tend to request a 20% down payment for the first-time homebuyers.

- Cities: The First-Home Mortgage Rate in Line with LPR in Shanghai and Comparatively Great Fluctuations in Guangdong

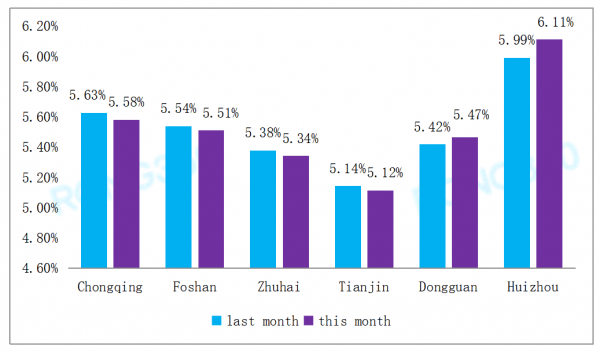

Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute indicated that February 2020 witnessed slight decreases by 1-5 BPs on a MoM basis in first-home mortgage rates in 19 cities, while first-home mortgage rates climbed up in 10 cities, including Huizhou where an uptrend of 12 BPs boosted it into the rank of the “6% Plus cities”.

Besides Beijing, three other cities cut their first-home mortgage rates again in February 2020. Guangzhou and Shenzhen saw a drop by 3 BPs on a MoM basis, while Shanghai, with a cut of 2 BPs on a MoM basis, hit a new low of 4.80%, which was in line with the five-year LPR of the corresponding period.

February 2020 witnessed a 5 BPs or higher variation of first-home mortgage rates in only three Tier-2 cities, Chongqing, Dongguan and Huizhou, decreased by 5 BPs, grew by 5 BPs and grew by 12 BPs respectively. The mortgage rates in the Guangdong proved to have fluctuated more significantly than in other provinces in that six of the 11 cities wavering by 3BPs or higher were located in Guangdong.

- Policy: City-specific Home Market Regulations and Unwavering Devotion to The Policy of No Speculation on Housing

In the wake of the coronavirus epidemic, more than 20 provinces and cities issued new real estate market polices in response. At the beginning, policies centered around talent-oriented mortgage subsidy and land supply. Since the last ten days of February, Zhumadian (Henan), Nanning (Guangxi), Dongguan (Guangdong), etc. had adjusted housing provident fund policies, including housing provident fund down payment percentage, loan limit, second-home mortgage loan and loan period.

Obviously the provinces and cities are pursuing different policies over the epidemic period based on different perspectives on the home market. Most of the initiatives are supposed to provide an incentive to rigid demands. Considering that the most recent five-year LPR released by the PBOC in February 20 decreased by 5 BPs, close attention should be drawn to whether there will further mortgage rate cuts in the future.

From a nationwide perspective, PBOC releases the Chinese Monetary Policy Executive Report Q4 2019 on the evening of February 19, the PBOC once more stressed that homes should serve practical residential needs rather than as a commercial investment. When in reply to the relevant hotspot questions, PBOC deputy governor Liu Guoqiang said the LPR drop would basically have a negligible impact on the Individual mortgage rate since the bank could keep it largely stable by adding basis points to the LPR.

Since 2020 the mortgage rate nationwide has been stabilizing with a slight fall. The tendency of stabilization is expected to go on in the future.

- Trends: The Benchmark Rate Shift Will Further Enable Online Mortgage Servicing; Banks are Stepping up Efforts to Implement a Differential Policy

In addition to mortgage rate, there are a couple of notable points concerning the future China Residential Mortgage Market.

First, the PBOC has requested that for the loans issued but not yet due, borrowers will need to sign new contracts with banks between March and August to shift the benchmark interest rate into the LPR. They can either choose a fixed rate or a floating rate that changes along with the LPR. Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute shows that most banks were almost finished drafting detailed policies and completing system development. Some banks said they would officially proceed with contract conversion for mortgagors who could then select mobile payment or other forms of online payment.

Second, authoritative media reported that China ZheShang Bank (CZBank) had empowered its branches in non-buying-restricted cities to reduce the down payment for the first-home mortgage from 30% to 20% based on buying restriction, mortgage restriction and other regulations. The policy shift caused extensive attention from the market.

In response to public opinion CZBank reconfirmed its strictly unwavering compliance with the authorities regarding a differential credit policy tailored to buying-restricted and non-buying-restricted cities. By doing this CZBank enforced a localized mortgage policy which is basically in line with general banking practice. In a legal sense, the move is in line with the PBOC’s latest Individual Housing Loan Policies.

While CZBank’s move is construed by some as a trial of the down payment policy shift, the move is indicative of the trend of the future mortgage strategy. In the future the banks are expected to get more deeply involved in enforcing the city-specific differential mortgage policy which will surely contribute to greater and more prominent diversity in mortgage rates.

Rong360 Jianpu Technology (NYSE:JT) Big Data Institute: Mortgage Rates to Be Stable Nationwide . ![]()