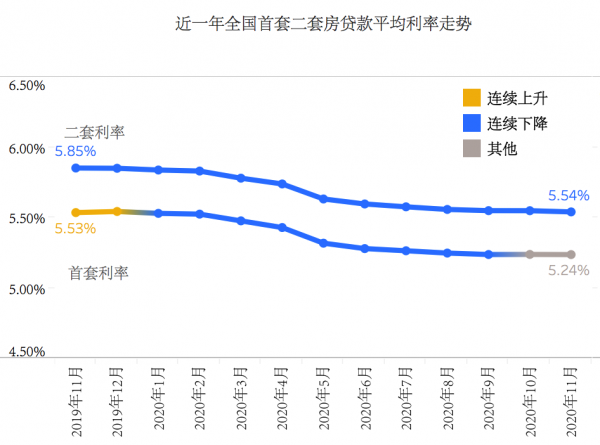

- Mortgage Rates: National Average First-home Mortgage Rate Remained Unchanged for Two Consecutive Months

According to surveillance data from Rong360 Big Data Research Institute across 674 bank branches in 41 major cities, in November 2020 (with data in statistics collected from October 20, 2020 to November 18, 2020), the national average mortgage rate for first-time homebuyers was 5.24%, the same as the previous month; The national average mortgage rate for second-time homebuyers was 5.54%, posting a decrease of 1 BP on a MoM basis.

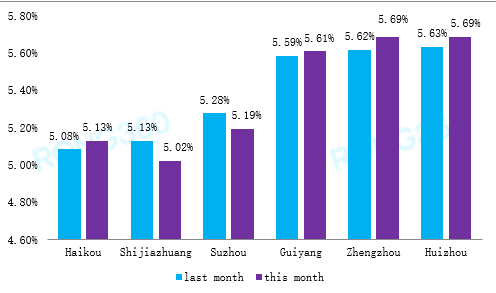

- Cities: Zhengzhou Saw Significant Rebound in Average Mortgage Rate; Suzhou and Shijiazhuang Recorded Lowest Mortgage Rates of The Year

According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities for November 2020 (with data in statistics collected from October 20, 2020 to November 18, 2020), 13 cities recorded a MoM increase in mortgage rates, 12 cities saw a MoM decrease in the rates, while the remaining 16 cities maintained the same levels as the previous month.

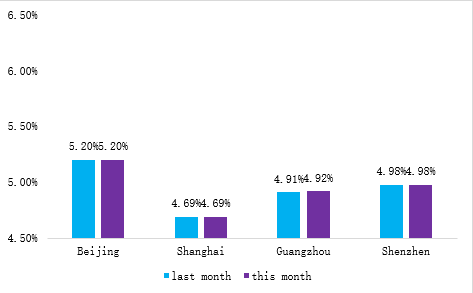

In November 2020 (with data in statistics collected from October 20, 2020 to November 18, 2020), the mortgage rates in tier-1 cities including Beijing, Shanghai and Shenzhen remained the same as the previous month. In Guangzhou, the average mortgage rate for first-time homebuyers increased by 1BP month-on-month while the rate for second-time homebuyers decreased by 1BP. It’s worth noting the mortgage rates in Guangdong have fluctuated in recent months while the changes were quite different in terms of adjustment ranges and directions across different banks.

In November 2020 (with data in statistics collected from October 20, 2020 to November 18, 2020), the mortgage rates in tier-1 cities including Beijing, Shanghai and Shenzhen remained the same as the previous month. In Guangzhou, the average mortgage rate for first-time homebuyers increased by 1BP month-on-month while the rate for second-time homebuyers decreased by 1BP. It’s worth noting the mortgage rates in Guangdong have fluctuated in recent months while the changes were quite different in terms of adjustment ranges and directions across different banks.

- Ranking: The Lists of Top 10 Cities with Lowest and Highest First-Home Mortgage Rates Remained Almost Unchanged

Chart 1 - Top 10 Cities with the Lowest First-home Mortgage Rate in November 2020

|

City |

Average Rate in November 2020 |

MoM (BP) |

LPR Increase (BP) |

|

Shanghai |

4.69% |

0 |

4 |

|

Harbin |

4.82% |

2 |

17 |

|

Urumqi |

4.85% |

-3 |

20 |

|

Guangzhou |

4.92% |

1 |

27 |

|

Dalian |

4.93% |

0 |

28 |

|

Tientsin |

4.95% |

0 |

30 |

|

Xiamen |

4.95% |

0 |

30 |

|

Shenzhen |

4.98% |

0 |

33 |

|

Zhuhai |

5.01% |

2 |

36 |

|

Foshan |

5.01% |

1 |

36 |

Source: Rong360 Jianpu Technology (NYSE: JT) Big Data Institute

Chart 2 - Top 10 Cities with the Highest First-home Mortgage Rate in November 2020

|

City |

Average Rate in November 2020 |

MoM (BP) |

LPR Increase (BP) |

|

Chengdu |

5.93% |

0 |

128 |

|

Wuxi |

5.92% |

2 |

127 |

|

Hefei |

5.88% |

0 |

123 |

|

Nanning |

5.86% |

0 |

121 |

|

Zhengzhou |

5.69% |

7 |

104 |

|

Huizhou |

5.69% |

6 |

104 |

|

Wuhan |

5.68% |

0 |

103 |

|

Guiyang |

5.61% |

2 |

96 |

|

Nanchang |

5.59% |

-3 |

94 |

|

Changsha |

5.47% |

-2 |

82 |

Source: Rong360 Jianpu Technology (NYSE: JT) Big Data Institute

In November 2020 (with data in statistics collected from October 20, 2020 to November 18, 2020), the lists of top 10 cities with the lowest and highest first-home mortgage rates were almost the same. Although the rankings of top 10 cities with the highest first-home mortgage rate had a slight change, Chengdu still sat atop the list with the highest rate for first-time homebuyers.

- Trends: Mortgage Rates Remained Stable by Year-end; More Regions Tightened Policies on Housing Provident Fund Loans

Overall, the nationwide mortgage rate market remained stable in November. Except large fluctuations in mortgage rates of Shijiazhuang, Suzhou and Zhengzhou, many other regions only had slight adjustments. In addition, some regions kept stable mortgage rates as a whole, but banks in the regions increased or decreased their own rates based on their conditions.

In terms of housing mortgage policies, more and more cities tightened rules over housing provident fund loans. Following Dongguan, Hefei, Wuxi, Zhengzhou, Changchun, etc., Nantong in Jiangsu province and Anshan in Liaoning province also adjusted related policies in November. For example, Nantong set stricter criteria to recognize the purchases of the first house while it prohibited providing housing provident fund loans for working families to buy a third house or more. Anshan adjusted housing provident fund loan policies from three respects, including the amount and proportion of the housing provident fund loans, rules for marital changes and the scope of transactions as well as requirements for employees who contribute to the provident fund in other cities. In addition, the Dongguan Housing Provident Fund Management Center in November lowered a “liquidity adjustment coefficient” from 0.8 to 0.6 for a situation when the amount of outstanding housing provident fund loans in the region is more than 90% but less than or equal to 95% of that of outstanding provident fund payments, as a means to reduce home loans that can be borrowed by people.

The People’s Bank of China (PBOC) in November kept the rate on one-year medium-term lending facility (MLF) the same as the previous level, thus loan prime rate (LPR) quotation is less likely to change. In December, nationwide mortgage rates are very likely to remain stable, but we could not exclude the possibility that major changes in mortgage policies of certain cities at the end of the year would affect the national average level of home loan rates.