Mortgage Credit Availability Loosened at End-2020; National Mortgage Rates Dropped 31BPs YoY

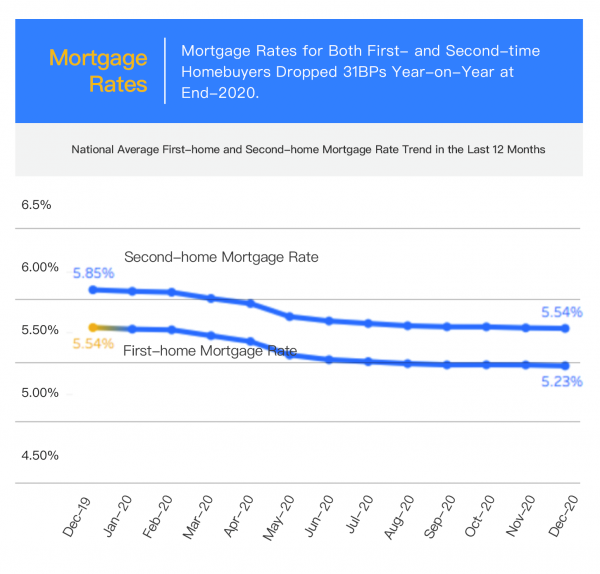

- Mortgage Rates: Mortgage Rates for Both First- and Second-time Homebuyers Dropped 31BPs Year-on-Year at End-2020.

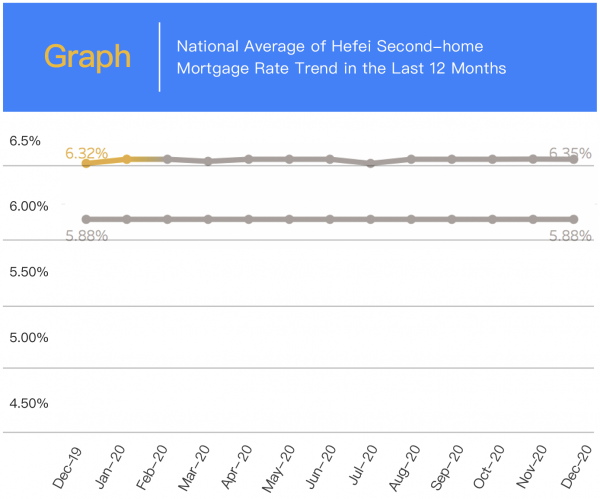

Graph 1 - National Average First-home and Second-home Mortgage Rate Trend in the Last 12 Months

Source: Rong360 | Jianpu Technology (NYSE: JT) Big Data Institute

Note: In the graph above, the samples used in statistics after January 2020 include data from 674 bank branches and sub-branches, while the samples used in statistics before January 2020 include data from 533 bank branches and sub-branches.

According to surveillance data from Rong360 | Jianpu Technology (NYSE: JT) Big Data Research Institute across 674 bank branches and sub-branches in 41 major cities, in December 2020 (with data in statistics collected from November 20, 2020, to December 18, 2020), the national average mortgage rate for first-time homebuyers was 5.23%, slightly decreasing by 1BP month-on-month (“MoM”); the national average mortgage rate for second-time homebuyers was 5.54%, the same as the previous month.

Compared with the data in 2019, mortgage rates for both first- and second-time homebuyers decreased by 31BPs year-on-year (“YoY”) in 2020, more than double the decrease in five-year LPR (15BPs).

- Cities: 38 Cities Recorded Mortgage Rate Decreases in 2020; Suzhou’s Mortgage Rate Dropped by Nearly 100BPs.

According to surveillance data from Rong360 | Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities for December 2020 (with data in statistics collected from November 20, 2020, to December 18, 2020), 11 cities recorded a MoM increase in mortgage rates, of which the rates in Chengdu and Dongguan each increased 4BPs MoM; 16 cities saw a MoM decrease in the rates, of which Changchun and Dalian suffered significant decreases of 16BPs and 9BPs, respectively. The remaining 14 cities maintained the same levels of rates as the previous month.

According to surveillance data from Rong360 | Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities, 38 cities recorded mortgage rate decreases in 2020. At the end of 2020, the first-home mortgage rates decreased by more than 15BPs YoY in 37 cities, of which seven cities each saw a decrease of more than 50BPs in the rates and 16 cities each saw a drop of between 30BPs and 50BPs.

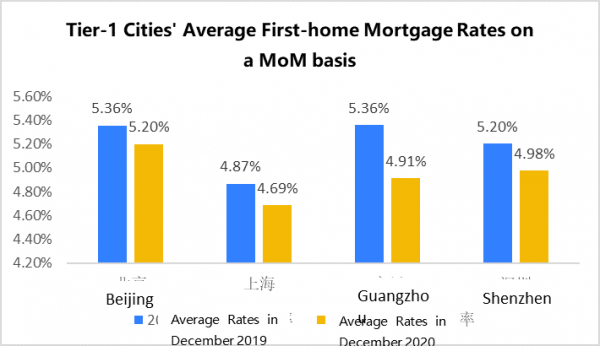

Graph 2 - Tier-1 Cities’ Average First-home Mortgage Rates on a MoM basis

Source: Rong360 | Jianpu Technology (NYSE: JT) Big Data Institute

Among the tier-1 cities, mortgage rates in Beijing, Shanghai, and Shenzhen have stronger correlations with LPR, and their fluctuation ranges are also more similar to that of LPR. At the end of 2020, the YoY decreases in mortgage rates for first- and second-time homebuyers were all between 15BPs and 25BPs in these three cities. In Guangzhou, the mortgage rate for first-time homebuyers had a significant decrease of 45BPs YoY, while its second-home mortgage rate dropped by 37BPs.

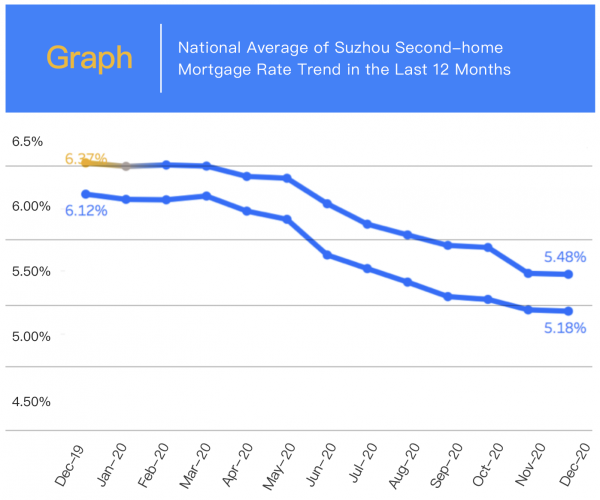

Graph 3 – Suzhou’s Average Second-home Mortgage Rate Trend in the Last 12 Months

Source: Rong360 | Jianpu Technology (NYSE: JT) Big Data Institute

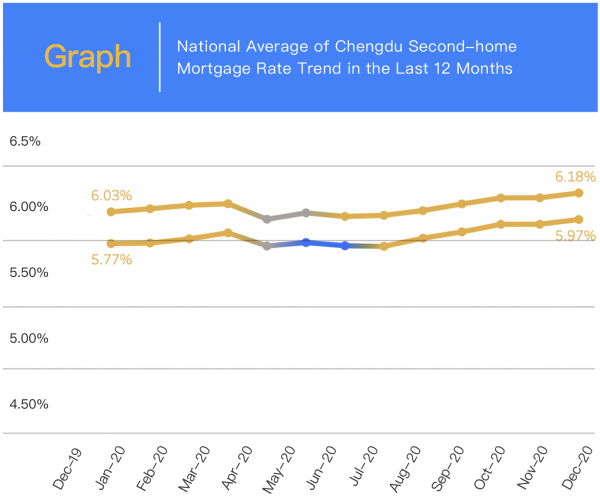

Graph 4 – Chengdu’s Average Second-home Mortgage Rate Trend in the Last 12 Months

Source: Rong360 | Jianpu Technology (NYSE: JT) Big Data Institute

Graph 5 – Hefei’s Average Second-home Mortgage Rate Trend in the Last 12 Months

Source: Rong360 | Jianpu Technology (NYSE: JT) Big Data Institute

The changes in mortgage rates of the second-tier cities varied by region. Suzhou saw the mortgage rate for first-time homebuyers drop rapidly from 6.12% in December 2019 to 5.18% in December 2020, representing a YoY decrease of 94BPs. In contrast, the mortgage rate for first-time homebuyers in Chengdu rose from 5.77% at the end of 2019 to the current level of 5.97%, representing a YoY increase of 20BPs. In addition, the mortgage rate in Hefei remained at a high level of 5.88% since the end of last year.

- Ranking: The Rankings of Top 10 Cities with Lowest and Highest First-Home Mortgage Rates Changed Significantly

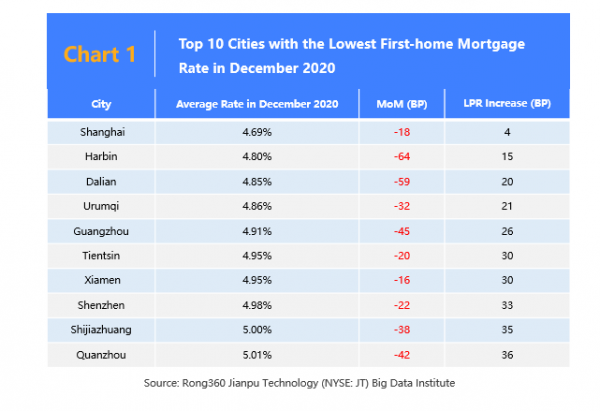

Chart 1 - Top 10 Cities with the Lowest First-home Mortgage Rate in December 2020

Source: Rong360 | Jianpu Technology (NYSE: JT) Big Data Institute

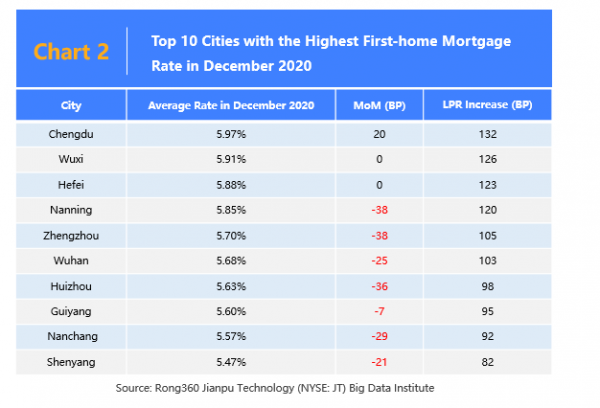

Chart 2 - Top 10 Cities with the Highest First-home Mortgage Rate in December 2020

Source: Rong360 | Jianpu Technology (NYSE: JT) Big Data Institute

At the end of 2020, the rankings of the top 10 cities with the lowest and highest first-home mortgage rates changed significantly compared with those at the end of 2019. Harbin, Dalian, and Quanzhou were included in the list of top 10 cities with the lowest first-home mortgage rate, while Beijing, Haikou, and Hangzhou were knocked off. Huizhou, Guiyang, and Shenyang were included in the list of top 10 cities with the highest first-home mortgage rate, while Suzhou, Zhongshan, and Xi’an were knocked off.

- Year-end Mortgage Credit Availability Increased Compared with Previous Years; Trend of “One City, One Strategy” Will Further Spread

In December 2020, the mortgage rates fluctuated slightly MoM, and there weren’t mortgage rate increases on a large scale nationwide near the end of the year. The availability of mortgage credit was not as tight as that in previous years, and only a small amount of banks suspended extending home loans. Throughout the year 2020, the fluctuations of mortgage rates, either nationwide or citywide, were more significant than those of last year. Additionally, the changes in the home mortgage market were reflected not only in mortgage rates but also in policies. In particular, regions that introduced related policies successively in the second half actively sought to implement the core principle of “housing is for living in, not for speculation.” This led to tightened policies on housing provident fund loans and down payments.

Through attempts and practices in the fourth quarter of 2019 and full year of 2020, China used LPR as a lending reference rate for new mortgage loans, and a converted rate benchmark for existing home loans. We expect the trend of “One City, One Strategy” in mortgage rates to further spread in the future. Fluctuation ranges of mortgage rates in the regions with stable real estate markets will closely follow that of five-year LPR if the increase points on top of LPR remain unchanged. Other regions will provide guidance over the increased points of mortgage rates based on the popularity of local property markets and fluctuations of five-year LPR.

Mortgage Credit Availability Loosened at End-2020; National Mortgage Rates Dropped 31BPs YoY