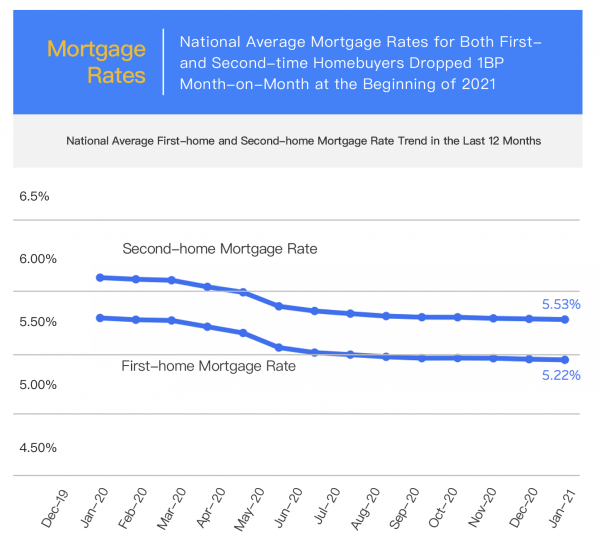

- Mortgage Rates: National Average Mortgage Rates for Both First- and Second-time Homebuyers Dropped 1BP Month-on-Month at the Beginning of 2021

Graph 1 - National Average First-home and Second-home Mortgage Rate Trend in the Last 12 Months

Source: Rong360 Jianpu Technology (NYSE: JT) Big Data Institute

Note: In the graph above, the samples used in statistics after January 2020 include data from 674 bank branches and sub-branches, while the samples used in statistics before January 2020 include data from 533 bank branches and sub-branches.

According to surveillance data from Rong360 Jianpu Technology (NYSE:JT) Big Data Research Institute across 674 bank branches and sub-branches in 41 major cities, in January 2021 (with data in statistics collected from December 20, 2020, to January 18, 2021), the national average mortgage rates for first- and second-time homebuyers were 5.22% and 5.53%, respectively, both decreasing by 1BP month-on-month (“MoM”).

At the beginning of 2021, mortgage rates dropped from the end of the previous year. The situation is the same as 2019 and 2020, however, it’s different from the trends in 2017 and 2018. This reflects the time that mortgage rates significantly increased has passed as the real estate market is becoming steady.

- Cities: More Cities Saw Mortgage Rates Decrease; The Gaps Among Cities’ Mortgage Rate Decreases Narrowed

According to surveillance data from Rong360 Jianpu Technology (NYSE:JT) Big Data Research Institute across the 41 cities for January 2021 (with data in statistics collected from December 20, 2020, to January 18, 2021), 9 cities recorded a MoM increase in mortgage rates, of which Zhongshan saw the most significant increases of 5BPs and 2BPs in first- and second-home mortgage rates, respectively.

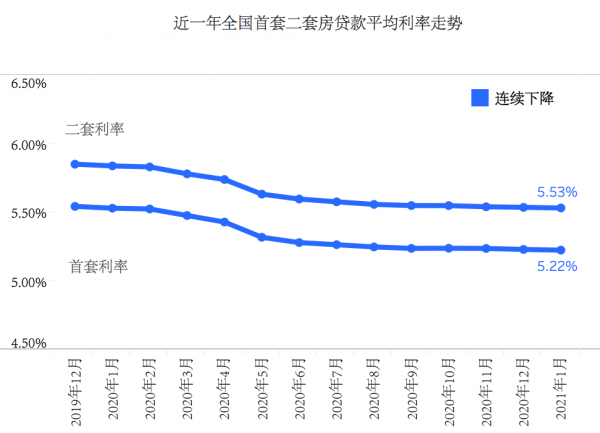

Graph 2 - Tier-1 Cities’ Average First-home Mortgage Rates on a MoM basis

Source: Rong360 Jianpu Technology (NYSE: JT) Big Data Institute

Among the tier-1 cities, mortgage rates in Beijing, Shanghai, and Shenzhen didn’t change since June 2020, while those in Guangzhou decreased successively. In January 2021, the average first-home mortgage rate in Guangzhou dropped 1BP MoM as three banks lowered their housing loan rates there.

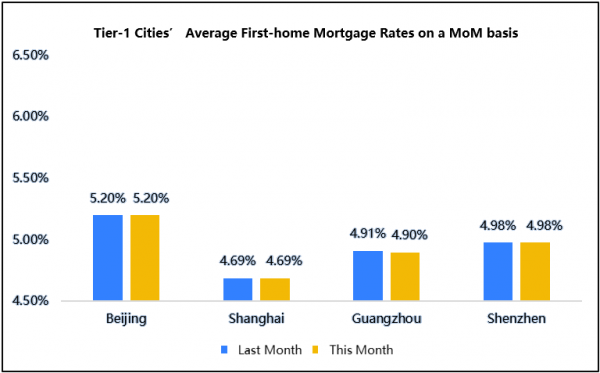

Graph 3 – Tier-2 Cities’ Average First-home Mortgage Rates on a MoM basis

Source: Rong360 Jianpu Technology (NYSE: JT) Big Data Institute

In January 2021, there was a growing number of second-tier cities seeing mortgage rates decrease MoM. However, the gaps among the decreases narrowed, staying between 1BP to 5BPs. Among the cities recording increases in mortgage rates, Zhongshan, Hangzhou, and Harbin saw the most significant increases of 5BPs, 4BPs, and 4BPs, respectively.

- Ranking: Shenyang Was Kicked Off China’s List for Top 10 Cities with Highest Mortgage Rates as Its First-home Mortgage Rate Decreased by 2BPs MoM

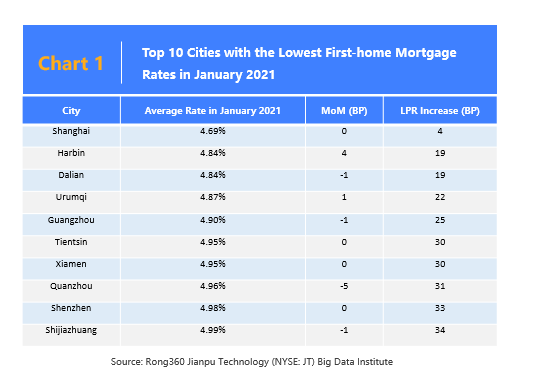

Chart 1 - Top 10 Cities with the Lowest First-home Mortgage Rates in January 2021

|

城市/City |

2021年1月平均利率/Average Rate in January 2021 |

利率值环比BP)/MoM (BP) |

LPR加点数/LPR Increase(BP) |

|

上海/Shanghai |

4.69% |

0 |

4 |

|

哈尔滨/Harbin |

4.84% |

4 |

19 |

|

大连/Dalian |

4.84% |

-1 |

19 |

|

乌鲁木齐/Urumqi |

4.87% |

1 |

22 |

|

广州/Guangzhou |

4.90% |

-1 |

25 |

|

天津/Tientsin |

4.95% |

0 |

30 |

|

厦门/Xiamen |

4.95% |

0 |

30 |

|

泉州Quanzhou |

4.96% |

-5 |

31 |

|

深圳/Shenzhen |

4.98% |

0 |

33 |

|

石家庄/Shijiazhuang |

4.99% |

-1 |

34 |

Source: Rong360 Jianpu Technology (NYSE: JT) Big Data Institute

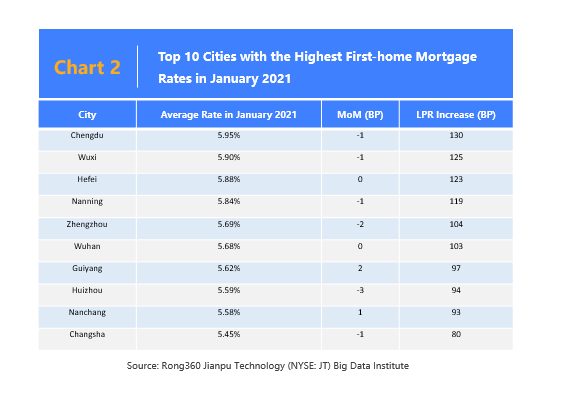

Chart 2 - Top 10 Cities with the Highest First-home Mortgage Rates in January 2021

|

城市/City |

2021年1月平均利率/Average Rate in January 2021 |

利率值环比(BP)/ MoM (BP) |

LPR加点数/LPR Increase(BP) |

|

成都/Chengdu |

5.95% |

-1 |

130 |

|

无锡/Wuxi |

5.90% |

-1 |

125 |

|

合肥/Hefei |

5.88% |

0 |

123 |

|

南宁/Nanning |

5.84% |

-1 |

119 |

|

郑州/Zhengzhou |

5.69% |

-2 |

104 |

|

武汉/Wuhan |

5.68% |

0 |

103 |

|

贵阳/Guiyang |

5.62% |

2 |

97 |

|

惠州/Huizhou |

5.59% |

-3 |

94 |

|

南昌/Nanchang |

5.58% |

1 |

93 |

|

长沙/Changsha |

5.45% |

-1 |

80 |

Source: Rong360 Jianpu Technology (NYSE: JT) Big Data Institute

In January 2021, the list for China’s top 10 cities with the lowest first-home mortgage rates didn’t change but Quanzhou slipped to the tenth lowest from the eighth as its average mortgage rate decreased significantly. Among the top 10 cities with the highest first-home mortgage rates, Shenyang was knocked off the list after a MoM decrease of 2BPs in its average first-home mortgage rate while Changsha was included in the list instead.

- New Policy Came into Effect for Over Half A Month, But Mortgage Credit Availability Hasn’t Yet Been Greatly Impacted

On the last day of 2020, the People's Bank of China and the China Banking and Insurance Regulatory Commission announced a property lending concentration management mechanism to impose ceilings on property loans by banks. The new system has set an upper limit on personal mortgage loans at as much as 32.5% of total outstanding yuan loans for first-tier lenders. The ratio requirements are lower for smaller banks. According to current property loan ratios of banks, only a small number of banks, which have exceeded the new requirements, are facing pressure to lower their property loan ratios. A majority of banks, especially medium and large ones, can still extend additional personal mortgage loans.

The new policy has been executed for over half a month, while financial institutions usually extend more credit at the beginning of a year. Therefore, the number of personal mortgage loans to be extended hasn’t yet been significantly affected, and there is still relatively sufficient availability for new loans. However, in the long-run perspective, banks are expected to reduce the total amount of new home loans available this year; or increase differentiated adjustments in mortgage credit availability across regions, reducing the availability in cities with relatively low mortgage rates and small profits from housing lending.

Mortgage rates dropped slightly at the beginning of 2021. The People’s Bank of China injected RMB500 billion worth of one-year medium-term lending facility (“MLF”) loans to financial institutions and kept the rate on the loans steady at 2.95% from previous operations. The LPR has a low possibility to change. Considering that mortgage credit availability hasn’t yet been affected much by the new policy, mortgage rates are expected to keep steady or drop slightly in the short term.