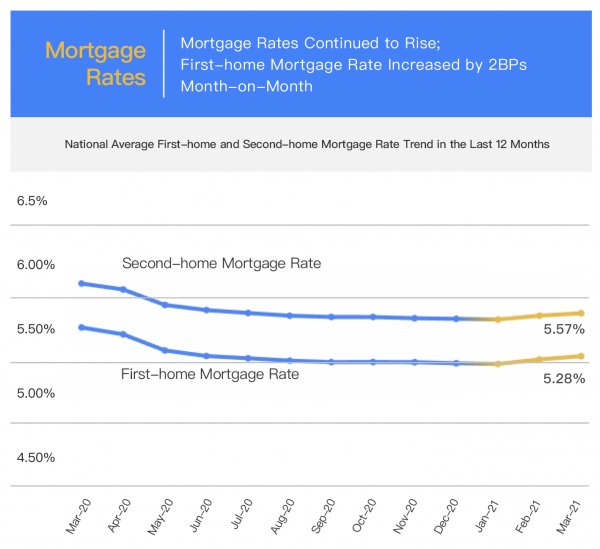

- Mortgage Rates: Mortgage Rates Continued to Rise; First-home Mortgage Rate Increased by 2BPs Month-on-Month

Mortgage rates in major cities increased further as a whole. According to surveillance data from Rong360 Big Data Research Institute across 674 bank branches and sub-branches in 41 major cities, the national average mortgage rate for first-time homebuyers was 5.28% in March 2021 (with data in statistics collected from February 20, 2021, to March 18, 2021), up 2 basis points (BP) month-on-month (MoM); The national average mortgage rate for second-time homebuyers was 5.57%, an increase of 1BP on a MoM basis.

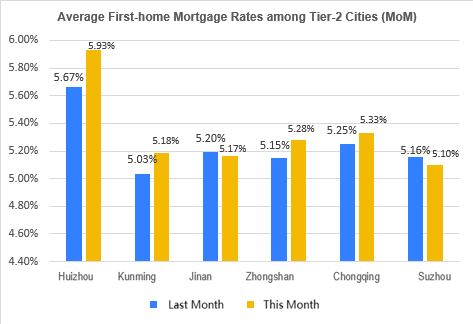

- Cities: Mortgage Rate for 20 Cities Rose on a MoM Basis; Guangdong Huizhou Saw an Increase of over 26BPs

According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities for March 2021 (with data in statistics collected from February 20, 2021, to March 18, 2021), 20 cities recorded a MoM increase in mortgage rates, four of which experienced a rise of over 10BPs. Huizhou saw the most significant growth, with first- and second-home mortgage rates rising by 26BPs on a MoM basis. Among the cities that witnessed MoM declines, Suzhou saw the highest drops of 6BPs and 3BPs for first- and second-time homebuyers respectively.

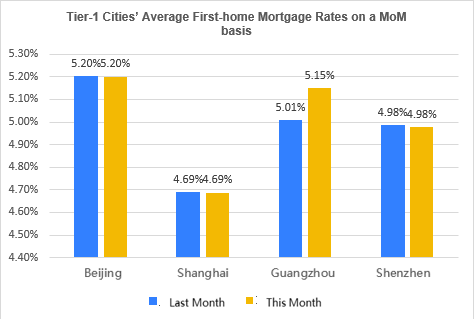

Among tier-1 cities in March 2021, Guangzhou continued to record an increase in the mortgage rate, with average first- and second-home mortgage rates increasing by 14BPs and 6BPs, respectively, on a MoM basis. Banks that have not raised mortgage rates or saw a modest rise in February also recorded an increase, with 5.2% and 5.4% becoming the mainstream first-home mortgage rate and second-home mortgage rates in Guangzhou. Meanwhile, mortgage rates for some joint-stock banks even climbed to 5.3% or 5.25% for first-home and 5.45% for second-home.

The mortgage rates in Beijing, Shanghai, and Shenzhen remained unchanged, but housing-related loans were tightened in these cities.

According to surveillance data from Rong360 Jianpu Technology Big Data Institute, 19 tier-2 cities recorded a MoM increase in mortgage rates in March 2021, three of which experienced an increase of over 10BPs. In addition to Huizhou, which saw the highest growth by 26BPs, the overall mortgage rate in Zhongshan, another city in Guangdong, posted a MoM increase of 13BPs. Kunming and Chongqing also recorded MoM increases of over 5BPs in mortgage rates. However, mortgage rates in Suzhou and Jinan dropped a bit.

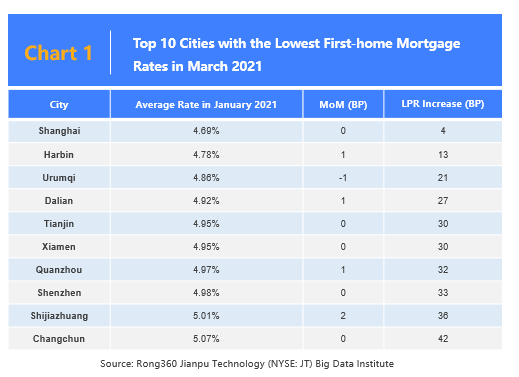

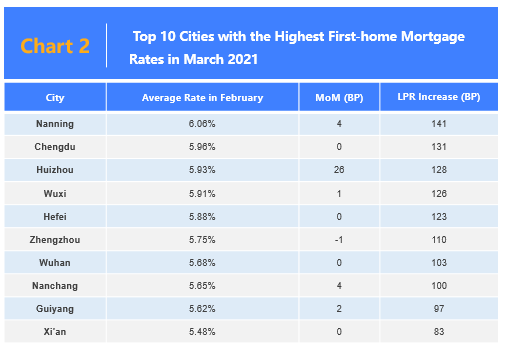

- Ranking: Guangzhou Dropped off the List of Top Ten Cities with Lowest First-home Mortgage Rate

In March 2021, we saw slight changes in the list of top 10 cities with the lowest first-home mortgage rates this month: Changchun replaced Guangzhou to made to the list. Meanwhile, there was no change in the top 10 cities with the highest first-home mortgage rates. Among rankings, Huizhou jumped to the third highest-rate city following a significant increase in mortgage rate.

- Mortgage Rate may Increase Further; Regulators are Conducting a Strict Investigation on Illicit Borrowings to the Housing Market

The property lending concentration management mechanism has been implemented for two and a half months. Hainan, Guangdong, Beijing, Shanghai, Zhejiang, Shandong, and some other cities successively published related local regulatory requirements. Among these cities, Guangdong, Hainan, Zhejiang, Shandong, and Sichuan raised ceilings for certain banks on the ratio of home mortgage loans.

Other than the new regulation mentioned above, popular housing markets have successively published new policies to tighten home loans. Almost all regions are conducting strict investigations into illicit consumer loans and business loans to the housing market. Some regional housing construction bureaus require housing businesses to investigate the capital source strictly. Regional policies like “Ten rules of Shanghai” and “Six rules of Dongguan” regulated in respect to setting purchase restrictions, raising transfer costs, and controlling loan amounts; Shanghai and Hangzhou include property sale by court order in the limitation; Shenzhen and Wuxi standardized the order of second-hand housing transactions; Dongguan also increased the down payment percentage for second homes from 40 percent to 50 percent.

Along with tightening home loans, control on mortgage amounts, investigating illegal capital for home purchases, second-hand housing, and the second home are key points for regulation. Mortgage rates are likely to rise further under stringent regulation on the property market. Meanwhile, the interest gap between individual business loans and home loans will further expand. The regulator conducted the most stringent investigation on individual business loans widely in order to avoid illicit borrowings used to speculate in the housing market.