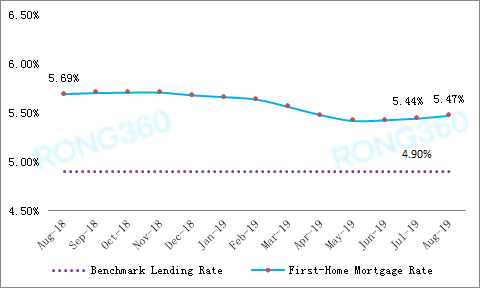

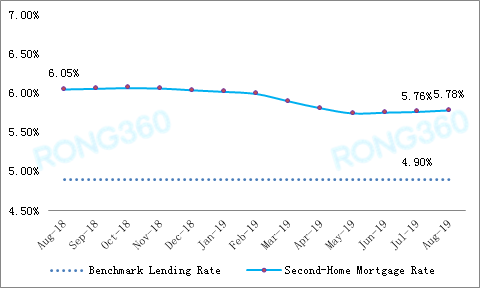

- Interest Rate: Average Interest Rates on Individual Mortgage Loans for First-Time and Second-Time Home Buyers Continue to Show Upward Trends, Corresponding to LPR Plus Basis Points of 62 BP and 93 BP, Respectively

The monitoring data released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute shows that in August 2019, the average interest rate on individual mortgage loans for first-time home buyers nationwide was 5.47%, posting an increase of 3 basis points (BP) on a month-on-month (MoM) basis. Meanwhile, the average interest rate on individual mortgage loans for second-time home buyers hit 5.78%, rising by 2BP MoM. Specifically, 62 BP and 93 BP have been respectively added on the basis of the 5-year LPR level – both much higher than the lower limit of the new policy.

- Cities: Widespread Upward Trends, With Rising City Coverage and Increase Rate

Monitoring data released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute for August 2019 shows a rise in interest rates on individual mortgage loans for first-time home buyers in 17 cities. Among the first-tier cities, the average interest rate on individual mortgage loans for first-time home buyers in Guangzhou increased by 4 BP in August, while other cities maintained the same level as the preceding month. Among the second-tier cities, the rate increased for three consecutive months in Suzhou, Wuxi, Shenyang, and Changsha, with the rise of up to 23 BP in Shenyang this month. On the whole, in comparison with the rates in June and July, August 2019 witnessed an increase in the number of cities that posted rising mortgage interest rates as well as the rates of increase.

3. Banks: Interest Rates of Over 100 Banks Lower Than the Lower Limit of New Regulation

Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute monitored 533 bank branches (sub-branches) in 35 cities. The results show that the first-home loan interest rates of 19 banks were still below 4.85%, while the second-home loan interest rates of 116 banks were below 5.45% – except for banks that have suspended loans. After the implementation of the new housing mortgage policy, these banks have to raise their mortgage interest rates, which in turn will further increase urban mortgage interest rates in many cities. According to the latest data, the overall levels of mortgage interest rates in Shanghai, Xiamen, and Tianjin are facing an upward pressure as they are also lower than the new regulatory limit.

- Rank list: LPR Plus Basis Point of Five Cities with Highest First-Home Loan Interest Rates is More Than 100BP

According to the monitoring data released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute for August 2019, there was no change as for the list of 10 cities with the lowest and highest average interest rates on individual mortgage loans for first-time home buyers. However, the rise of interest rates on mortgage loans in several cities has caused the gap in specific rankings. According to the new benchmark LPR, the plus basis points of the cities ranking in top five with respect to the interest rate is over 100 BP. Among the 10 cities with the lowest interest rates on loans for second-time home buyers, Xiamen, with a rate of 5.39%, became the city with the lowest mortgage rate; followed by Tianjin, with a rate of 5.41%. Both the rates are lower than the lower limit of the new regulation (5.45%).

In August 2019, Shenyang registered the highest increase (23 BP) in interest rates on individual mortgage loans for first-time home buyers. Meanwhile, since banks have recently carried out a new round of upward adjustment, the mortgage interest rate of Jinan, after being stable since June, has increased by 18 BP. In addition, Nanchang, Kunming, and Nanning also their increased rates by over 10 BP in August.

Chart 1-1 Top 10 Cities with Lowest First-Home Mortgage Rates in August, 2019

|

City |

Average Mortgage Rate |

LPR of corresponding maturity plus basis points of the Last Month |

|

Shanghai |

4.84% |

-1 |

|

Xiamen |

4.90% |

5 |

|

Tianjin |

5.11% |

26 |

|

Urumqi |

5.17% |

32 |

|

Shenzhen |

5.19% |

34 |

|

Zhuhai |

5.27% |

42 |

|

Haikou |

5.28% |

43 |

|

Harbin |

5.29% |

44 |

|

Dalian |

5.29% |

44 |

|

Hangzhou |

5.34% |

49 |

Source: Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute

Chart 1-2 Top 10 Cities with Lowest Second-Home Mortgage Rates in August, 2019

|

City |

Average Mortgage Rate |

LPR of corresponding maturity plus basis points of the Last Month |

|

Xiamen |

5.39% |

54 |

|

Tianjin |

5.41% |

56 |

|

Shanghai |

5.46% |

61 |

|

Shenzhen |

5.49% |

64 |

|

Zhuhai |

5.54% |

69 |

|

Urumqi |

5.55% |

70 |

|

Hangzhou |

5.58% |

73 |

|

Guangzhou |

5.59% |

74 |

|

Dalian |

5.59% |

74 |

|

Fuzhou |

5.62% |

77 |

Source: Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute

Chart 1-3 Top 10 Cities with Highest First-Home Mortgage Rates in August, 2019

|

City |

Average Mortgage Rate |

LPR of corresponding maturity plus basis points of the Last Month |

|

Suzhou |

6.04% |

119 |

|

Nanning |

6.01% |

116 |

|

Hefei |

5.92% |

107 |

|

Wuhan |

5.92% |

107 |

|

Wuxi |

5.88% |

103 |

|

Nanchang |

5.78% |

93 |

|

Zhengzhou |

5.77% |

92 |

|

Nanjing |

5.69% |

84 |

|

Chengdu |

5.65% |

80 |

|

Qingdao |

5.64% |

79 |

Source: Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute

Chart 1-4: Top 5 Cities with Highest Increase in First-Home Mortgage Rates in August 2019

|

City |

July Mortgage Rate |

August Mortgage Rate |

BP |

|

Shenyang |

5.29% |

5.52% |

23 |

|

Jinan |

5.37% |

5.55% |

18 |

|

Nanchang |

5.64% |

5.78% |

15 |

|

Kunming |

5.29% |

5.41% |

12 |

|

Nanning |

5.90% |

6.01% |

11 |

Source: Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data

- Capital in Real Estate Market is Strictly Controlled, While Pullback of Mortgage Rate is Unlikely in Short-Term

A few banks in some regions have adopted the LPR for quoting new mortgage loans. This adjustment in the quotation method has had little impact on the actual mortgage interest rates. Recently, PBOC lowered the deposit-reserve ratio, which is expected to decrease the banks’ funding costs. Nonetheless, be it the lowering of deposit-reserve ratio or the introduction of the new LPR quotation mechanism, it is expected that to further support the development of the real economy and lower financing costs. At the policy level, it has been explicitly made clear that the real estate will not be used as a means of short-term economic stimulus, while capital containment and violation inspection by regulators shall be far more stringent than it was in the past. In the short run, this policy is expected to reduce the real economy financing costs, there is little chance that the mortgage rate will go down.

Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute: China Mortgage Rate Uptrend Continues, Unlikely to Go Down in Short-term![]()