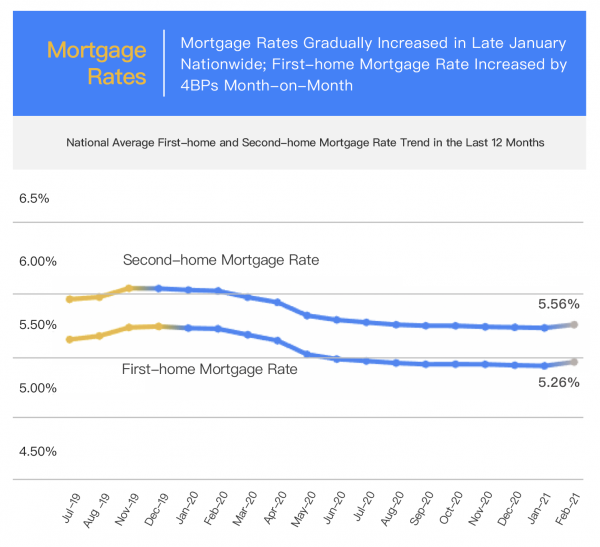

- Mortgage Rates: Mortgage Rates Gradually Increased in Late January Nationwide; First-home Mortgage Rate Increased by 4BPs Month-on-Month

Note: In the graph above, the samples used in statistics after January 2020 include data from 674 bank branches and sub-branches, while the samples used in statistics before January 2020 include data from 533 bank branches and sub-branches.

According to surveillance data from Rong360 Big Data Research Institute across 674 bank branches and sub-branches in 41 major cities, in February 2020 (with data in statistics collected from January 20, 2020 to February 18, 2020), the national average mortgage rate for first-time homebuyers was 5.26%, increasing by 4 basis points (BP) month-on-month (MoM); The national average mortgage rate for second-time homebuyers was 5.56%, an increase of 3BPs on a MoM basis.

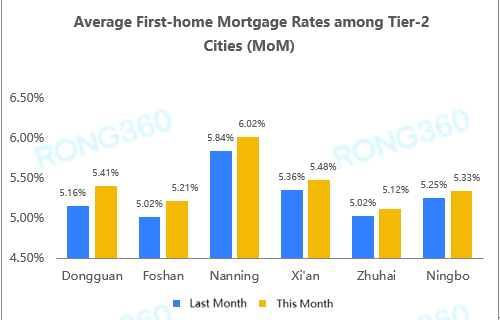

- Cities: Mortgage Rate of 18 Cities Rose on a MoM Basis; Dongguan’s First-home Mortgage Rate Saw an Increase of over 25BPs

According to surveillance data from Rong360 Jianpu Technology (NYSE: JT) Big Data Institute across the 41 cities for February 2020 (with data in statistics collected from January 20, 2020 to February 18, 2020), 18 cities recorded a MoM increase in mortgage rates, six of which experience an increase of over 10BPs. Five cities posted MoM decreases in mortgage rates with the highest drops of 7BPs and 3BPs for first- and second-time homebuyers, respectively.

Since late January 2020, a new round of tighter regulations on the mortgage market was imposed, which gradually spread from tier-1 cities to hot spots in major property markets. Guangzhou is the most affected by the new policy. In just a few days, the city experienced a tightened quota, an uncertain loan cycle, and increased mortgage rates of average first- and second-home mortgage rates increasing by 11BPs and 4BPs, respectively, on a MoM basis.

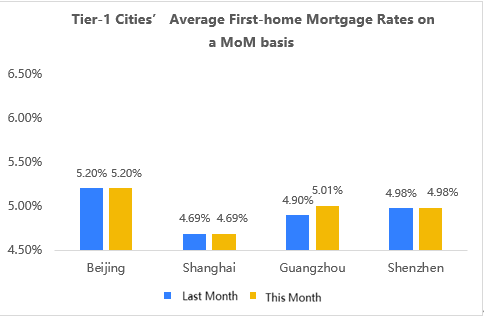

The mortgage rate in tier-1 cities including Beijing, Shanghai, and Shenzhen remained unchanged, even as regulations have been tightened in these cities. The announcement about tightened mortgage loans first came out from Shenzhen and Shanghai, while the mortgage market was relatively stable with the same rate in Beijing. Additionally, many banks in Beijing stated the mortgage business went on, as usual, saying they have not received any notices related to tightening mortgage loans yet. However, violations regarding mortgage loans were strictly investigated.

In tier-2 cities, a number of regions’ mortgage rates hit new highs.

Except for Guangzhou, other regions in Guangdong raised mortgage rates, of which Dongguan and Foshan increased rates overall. Dongguan saw the most significant increase with first- and second-home mortgage rates rising by 25BPs and 27BPs on a MoM basis, respectively. Foshan, Zhuhai, and Huizhou posted growth in the rates as well.

Most other tier-2 cities saw increases in mortgage rates as well. Nanjing recorded a MoM increase of 18BPs in the mortgage rate, lifting it back to the level of over 6%. The highest increase in Nanning reached 6.3%. Ningbo, Zhengzhou, and Dalian also saw increases of over 5BPs.

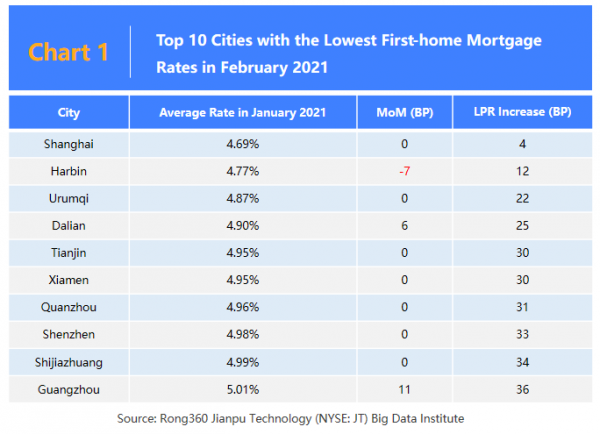

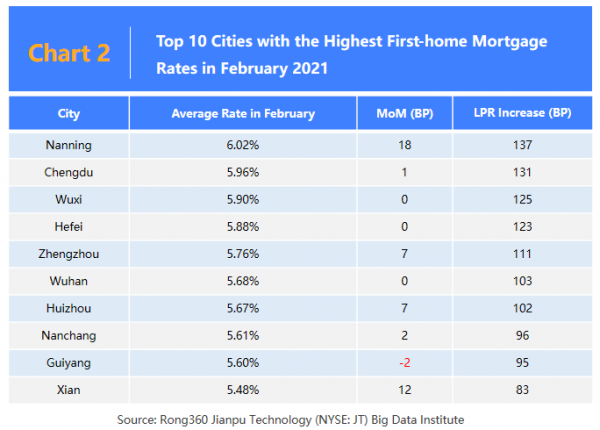

- Ranking: Nanning regained the No.1 with first home mortgage rate being back over 6%

In February 2021, the list for China’s top 10 cities with the lowest first-home mortgage rates remained unchanged. Among the top 10 cities with the highest first-home mortgage rate, Nanning regained the No.1 with first home mortgage rate back over 6%.

- With a new round of regulations triggered, the mortgage rate is expected to rise further

Beginning in late January, a number of cities released signals of tightening mortgage markets. January is typically a month with sufficient mortgage loans for many banks. While this January, along with the rising mortgage rate, mortgage loans for these banks have been tightened and some even have to suspend their loan business, demonstrating the power of the concentrated regulation. For certain other regions where the mortgage rate and loan amount were not impacted, people working at banks stated the mortgage rate might increase near term.

The new round of regulations on home mortgages and the increased mortgage rates had little relation to the adjustment of 5-year LPR. On February 20, The People’s Bank of China announced the latest LPR remains unchanged, while the impact of the regulation is spreading and there may be more regions to follow the rise in mortgage interest rates in the future.