- Interest Rate: LPR quotation Remains Unchanged, and Average Interest Rate on Home Mortgage Nationwide Rose Further by 1BP

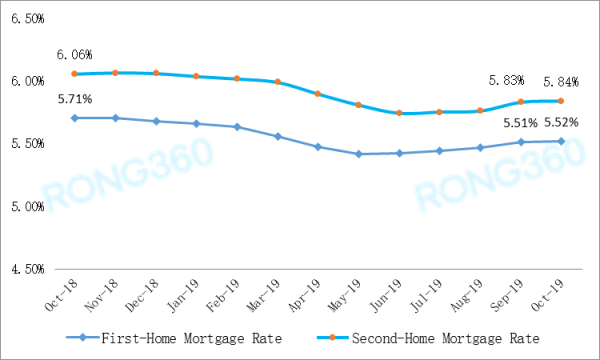

The monitoring data released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute shows that the average mortgage rate for first-time homebuyers nationwide in October 2019 was 5.52%, posting an increase of 1 basis point (BP) on a month-on-month (MoM) basis. Specifically, 67 BPs have been added above the 5-year LPR[1] . The average mortgage rate for second-time homebuyers was 5.84%, posting an increase of 1 BP on a MoM basis. Specifically, 99 BPs have been added above the corresponding LPR level.

[1] Unless otherwise specified, LPR in this report refers to the 5-year LPR quotation published on September 20, 2019, covering the statistical period from September 20 to October 19.

- Cities: Uptrend Slowed Down from the Prior Two Months; the Mortgage Rates for First-time Homebuyers in Eight Cities Declined

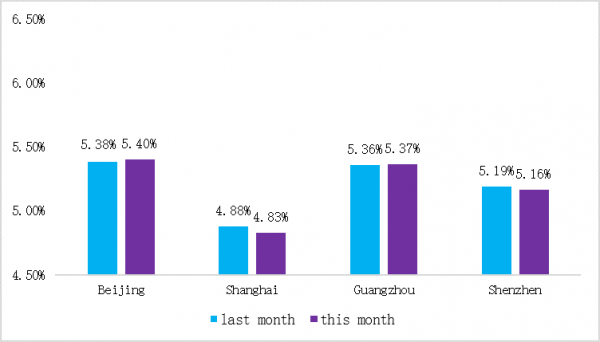

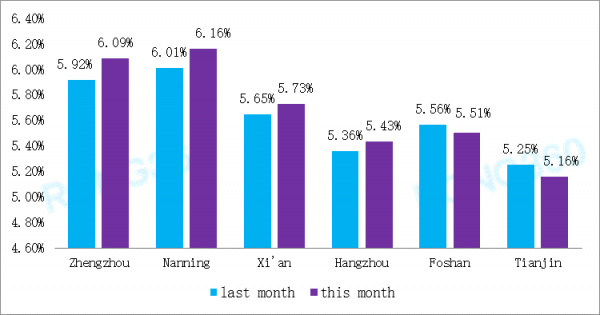

On the whole, the upward trend of housing mortgage rates across China slowed down in October, and the mortgage rates for first-time homebuyers in eight cities declined. All first-tier cities were included in the list of ten cities with the lowest mortgage rates for first-time homebuyers, among which the housing mortgage rates of Beijing and Guangzhou slightly rose, while those of Shanghai and Shenzhen dropped. Fewer second-tier cities offered higher or the same mortgage rates for first-time homebuyers compared with the prior month: Zhengzhou and Nanning witnessed the most significant rises in October with the MoM rising by more than 10 BPs, and the number of cities with the mortgage rates for first-time homebuyers exceeding 6% increased to four: Nanning, Zhengzhou, Suzhou and Wuhan.

- Banks: 45% of the Banks Raised Mortgage Rates in October; Most Banks Have Implemented the New LPR-based Housing Mortgage Policy

According to the monitoring data released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute, the absolute majority of 533 bank branches (sub-branches) in 35 cities have implemented the new LPR-based housing mortgage policy by the end of October. Excluding banks that have suspended the housing mortgage loan issuance, 238 bank branches (sub-branches), compared with 101 in September and accounting for 44.65% of the monitored bank branches (sub-branches), raised their mortgage rates for first-time homebuyers on a MoM basis; 79 bank branches (sub-branches), compared with 45 in September and accounting for 14.82% in the monitored bank branches (sub-branches), lowered their mortgage rates on a MoM basis; and 207 bank branches (sub-branches), compared with 389 in September, maintained the same mortgage rates as the prior month.

A significant increase is noted in the number of banks that raised the mortgage rates in October, while a significant decrease is noted in the number of banks that maintained the same mortgage rates as September. The reasons for such changes are: for one thing, the banks had limited credit lines and other inherent factors; for another, many banks’ previous actual housing mortgage rates based on benchmark interest rates were accurate to three decimal places, while after the implementation of the new housing mortgage policy, some banks rounded off the last decimal place of the housing mortgage rate in order to be consistent with the number of decimal places of LPR for Base Point addition (accurate to two decimal places), which was equivalent to a rise by 0.5 BP.

According to the data, however, in addition to Shanghai that is specially allowed to offer the mortgage rate for first-time homebuyers that is lower than LPR, more than a dozen banks in Guangzhou, Shenzhen, Tianjin, Shanghai and other places still offer mortgage rates for second-time homebuyers that is below the lower limit under the new policy, and these banks are likely to adjust their mortgage rates later.

- Trend: The LPR-based New Policy Has Been Implemented by Most Banks; the Housing Mortgage Rates Are Unlikely to Drop before 2020

By the end of October, 35 key cities across China have basically determined the lower limit for BP addition and transited from the old policy to the new one. Compared with October 8, the first day of the official implementation of the new mortgage policy, when only less than half of the banks monitored in Guangzhou have implemented the policy, now all of the 23 monitored banks have implemented the new policy. All the banks in second-tier cities have implemented the new policy and preliminarily transited to the new policy. It is just that they are less prepared for the quotation method compared with the banks in first-tier cities and still need some time to transit from forced BP addition to the positive adjustment.

The actual mortgage rate in October maintained the upward trend of the four prior months but slowed down, and more cities offered lower rates. It has been initially verified that the housing mortgage level has not been significantly impacted by LPR in the short term. Therefore, the subsequent adjustment of LPR is unlikely to cause large fluctuations of mortgage rates. Considering that banks would tighten the credit lines in the last two months of the year, it is expected that the mortgage rate will still rise slightly or remain stable before the end of the year, and is unlikely to decline.

Statement

Disclaimer: The data in this report are obtained through public channels. Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute strives to be accurate and reliable, but does not guarantee the accuracy and completeness of these data, and does not assume legal responsibility arising from data problems. Any user who cites, reprints and distributes the report to third parties agrees that the risks and consequences of the data issue are entirely at their own risk.

Copyright Announcement: In order to protect the legitimate rights of the author and Rong360 Jianpu Technology Inc. (NYSE:JT) Big Data Institute in accordance with the law, and to reasonably regulate the online communication of the corresponding works, the original information and content resources of the Rong360 Jianpu Technology Inc. (NYSE:JT) Big Data Institute must be reprinted from the "Rong360" or " Rong360 Jianpu Technology Inc. (NYSE:JT) Big Data Institute, otherwise processed according to infringement, Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute reserves the right of final interpretation.