- Mortgage Rate: The Mortgage Rate Stopped Increasing for Six Consecutive Months and Declined Slightly by 1 BP in December

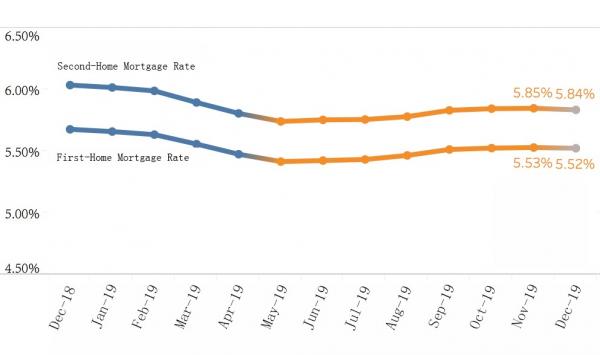

On November 20, the five-year LPR, which is the reference for new mortgage interest, was declined for the first time, leading to a slight decrease of the mortgage rate nationwide after increasing for six consecutive months. The monitoring data released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute shows that the average mortgage rate for first-time homebuyers in 35 cities under monitoring was 5.52% in December 2019 (Data collected from November 20, 2019 to December 19, 2019), posting a decrease of 1 basis points (BP) on a month-on-month (MoM) basis. Specifically, 72 BP have been added above the five-year LPR. Additionally, the average mortgage rate for second-time homebuyers was 5.84% in December 2019, posting a decrease of 1BP’s on a MoM basis. Specifically, 104 BP have been added above the five-year LPR.

The average mortgage rate nationwide declined and then rose in the year of 2019. However, as shown in the graph above, the change in the second half of the year was significantly slighter than that in the first half of the year, which reflects that the recent operation of real estate regulatory policies and real estate market are both relatively stable.

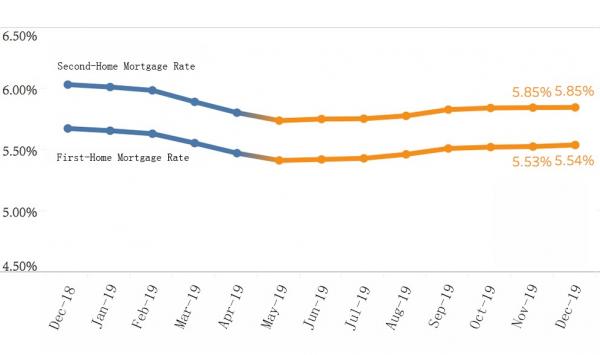

In order to reflect the nationwide mortgage rate more objectively, Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute includes Zhongshan city of Guangzhou province in key monitoring cities since December 2019. The number of joint-stock Banks in some monitoring cities are also increased and the sample size changed from 533 bank branches (sub-branches) in 35 cities to 613 bank branches (sub-branches) in 36 cities.

According to the monitoring data of the 613 bank branches (sub-branches), in December 2019, the average mortgage rate for first-time homebuyers was 5.54%. Specifically, 74 BP have been added above the five-year LPR. Additionally, the average mortgage rate for second-time homebuyers was 5.85%. Specifically, 105 BP have been added above the five-year LPR. This is mainly because the mortgage rate in the newly added Zhongshan city was relatively high and pulled up the national level on the whole.

- City: The Mortgage Rate Fell Back in Tier 1 Cities; The Mortgage Rate was Mixed in Tier 2 Cities

The monitoring data released by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute shows that the average mortgage rate for first-time homebuyers among 18 cities was lowered in December 2019, accounting for half of the monitoring cities, but the average mortgage rate for first-time homebuyers among 12 cities was increased. The second-home mortgage rate fell in only 11 cities, compared with 17 that rose. We believe that in the context of "no speculation" policy, banks may give more financial priority to the first-time homebuyers and raise the cost of buying a second house.

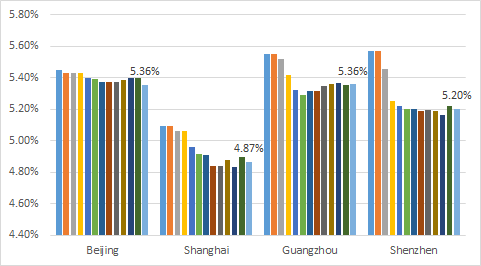

Among Tier 1 cities, in December 2019, Beijing, Shanghai and Shenzhen saw slight rate drops but Guangzhou saw increasing first-home mortgage rate. The first-home mortgage rate in Beijing decreased by 4 BP’s on a MoM basis, and the changes among 23 banks were in line with the five-year LPR (the MoM decline is 5 BP’s). The first-home mortgage rate in Shanghai was declined by 3 BP’s on a MoM basis, and 8 Banks lowered the rate by 5 BP’s on a MoM basis. The first-home mortgage rate in Shenzhen was decreased by 3 BP’s on a MoM basis, and 14 Banks lowered the rate by 5 BP’s on a MoM basis.

For the whole year, the mortgage rate for first-time homebuyers in Tier 2 cities has dropped to different extents from where it began the year. The mortgage rate in Beijing was the most stable. Shanghai always scored the lowest mortgage rate in Tier 2 cities. The mortgage rate was the most volatility in Shenzhen, down 37 BP from the start of the year.

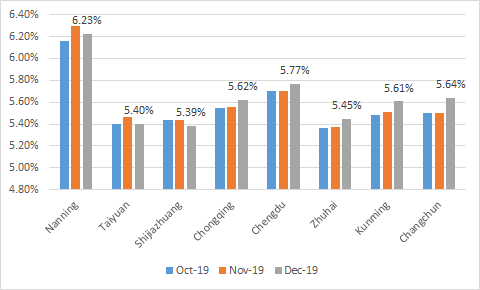

Among Tier 2 cities, in December 2019, the mortgage rate for first-time homebuyers in 8 cities changed by more than 5 BP. The mortgage rate in Nanning, Taiyuan, and Shijiazhuang had a MoM decrease. Changchun, Kunming, Chongqing, Chengdu and Zhuhai also saw an up on a MoM basis.

- Bank: 175 Banks Reduced the Mortgage Rate of December in 2019

On November 20th, 5-year LPR initially declined by 5 BP to 4.80% at the fourth quotation. Though approaching to the end of the year, many banks adjusted the rate as followed.

Among the 613 banks branches(sub-branches) in 36 cities monitored by Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Research Institute, 175 banks reclined the mortgage rate for first-time homebuyers excluding the newly added sample banks and banks terminating the debt, increasing by 109 banks. 105 banks branches (sub-branches) declined the rate by 5BP as the decline degree of LPR, accounting 17.13% of the total banks. These banks are mainly based in Beijing, Shenzhen, Shanghai, Tianjin, Xiamen, Zhuhai and Dongguan; 278 banks keep the same level as last month; 68 banks increased the rate mom, decreasing by 5 banks.

- Ranking: the Range of Cities with Low Mortgage Rate Expands

Chart 1 – The Top 10 Cities with the Lowest Mortgage Rate in December 2019

|

City |

Average Mortgage Rate |

BP |

LPR |

|

Shanghai |

4.87% |

-3 |

7 |

|

Xiamen |

5.11% |

-4 |

31 |

|

Tianjin |

5.15% |

-4 |

35 |

|

Urumqi |

5.18% |

-3 |

38 |

|

Shenzhen |

5.20% |

-2 |

40 |

|

Haikou |

5.33% |

2 |

53 |

|

Beijing |

5.36% |

-4 |

56 |

|

Guangzhou |

5.36% |

1 |

56 |

|

Shijiazhaung |

5.39% |

-6 |

59 |

|

Hangzhou |

5.39% |

-3 |

59 |

Chart 2 – The Top 10 Cities with the Highest Mortgage Rate in December 2019

|

City |

Average Mortgage Rate |

BP |

LPR |

|

Nanning |

6.23% |

-7 |

143 |

|

Suzhou |

6.12% |

0 |

132 |

|

Zhengzhou |

6.08% |

-4 |

128 |

|

Wuhan |

5.93% |

0 |

113 |

|

Wuxi |

5.91% |

2 |

111 |

|

Hefei |

5.88% |

-2 |

108 |

|

Nanchang |

5.86% |

-2 |

106 |

|

Chengdu |

5.77% |

7 |

97 |

|

Zhongshan |

5.73% |

- |

93 |

|

Xian |

5.73% |

0 |

93 |

Source: Rong360 Jianpu Technology Inc. (NYSE: JT) Big Data Institute

In December 2019, expect Haikou and Guangzhou, the other cities ranking in top 10 with the lowest mortgage rate declined the rate. Shijiazhuang declined by 6BP and made Zhuhai be out if the top 10. The mortgage rate of Zhongshan city, which is newly included in the top ten, is 5.73%.

- Trends: The Measure of “Different City Enforces Different Policy” was Implemented Gradually, Mortgage Rate Has Decline Room

In December, the topic, House is for living not for earning, was emphasized again in the Central Economic Working Conference. Ministry of Housing and Urban-Rural Development added a long period validity of the policy when deployed the relative work in 2020,which highlighted the policy will exists as a regulatory norm.

At the same time, as approaching the end of the year, many regions are implementing the “Different City Enforces Different Policy” gradually, and real estate market policies have begun to be adjusted. A dozen of second-tiers cities like Tianjin, Nanjing, Wuhan, Sanya and Foshan lower the threshold of house buying for talent people, which insert the energy for the real estate market with watching the expecting status. In December, Nansha District, Huadu District and Huangfu District of Guangzhou released announcement to relax the talent purchase restrictions, becoming the first and only first-tier city to adjust its housing policies. In Shenzhen, due to the blessing of a number of favorable factors such as the "First Demonstration Zone" and the "Adjustment of the Standard of Ordinary Houses", some second-hand housing prices rose fast. In response, the Shenzhen Municipal Bureau of Housing and Construction issued a special notice to crack down on illegal activities such as driving up housing prices.

On December 20, the latest LPR quotation has not changed, but considering the current economic situation, there is still decline room in the future. Under the circumstance that the talent policy is relaxed in many places and the market capital is relatively loose, the mortgage interest rate of Banks will be lowered along with LPR next year. However, the range and speed of the downward adjustment will be relatively slight, and a stable development will remain the main theme of the real estate market in 2020.